- Home

- About Us

- Expertise

- Why Choose Us

- Practice Areas

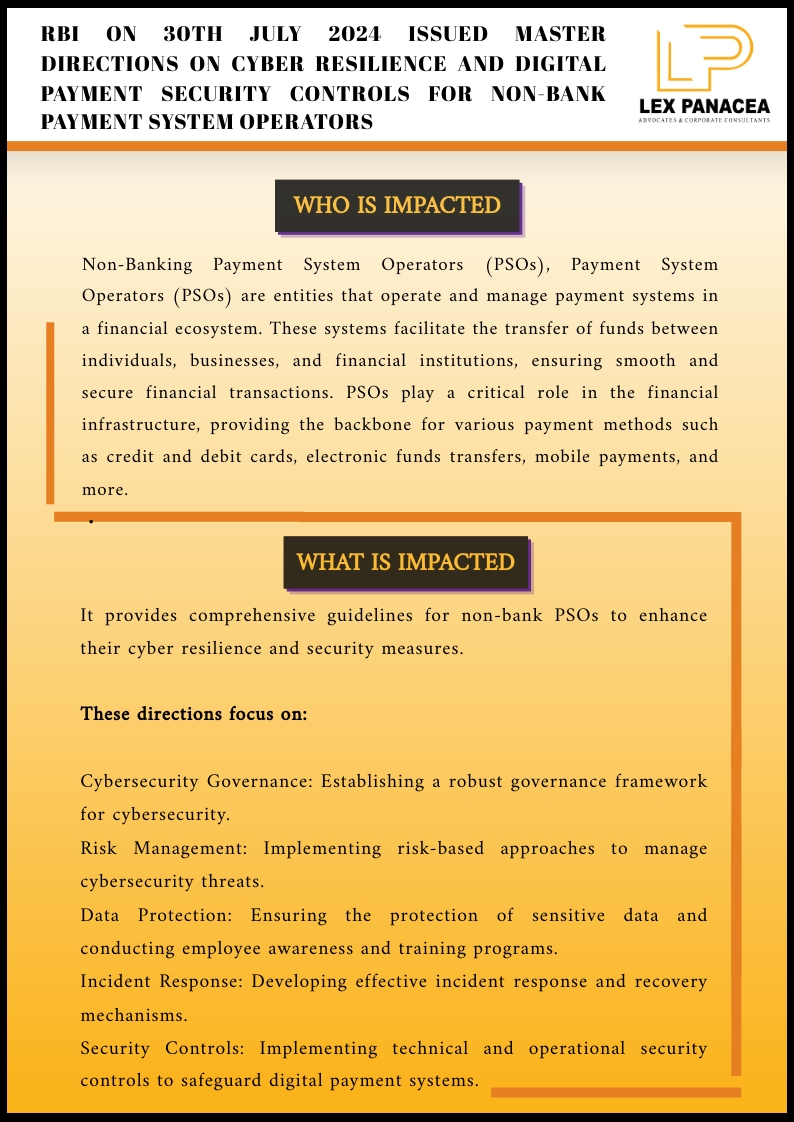

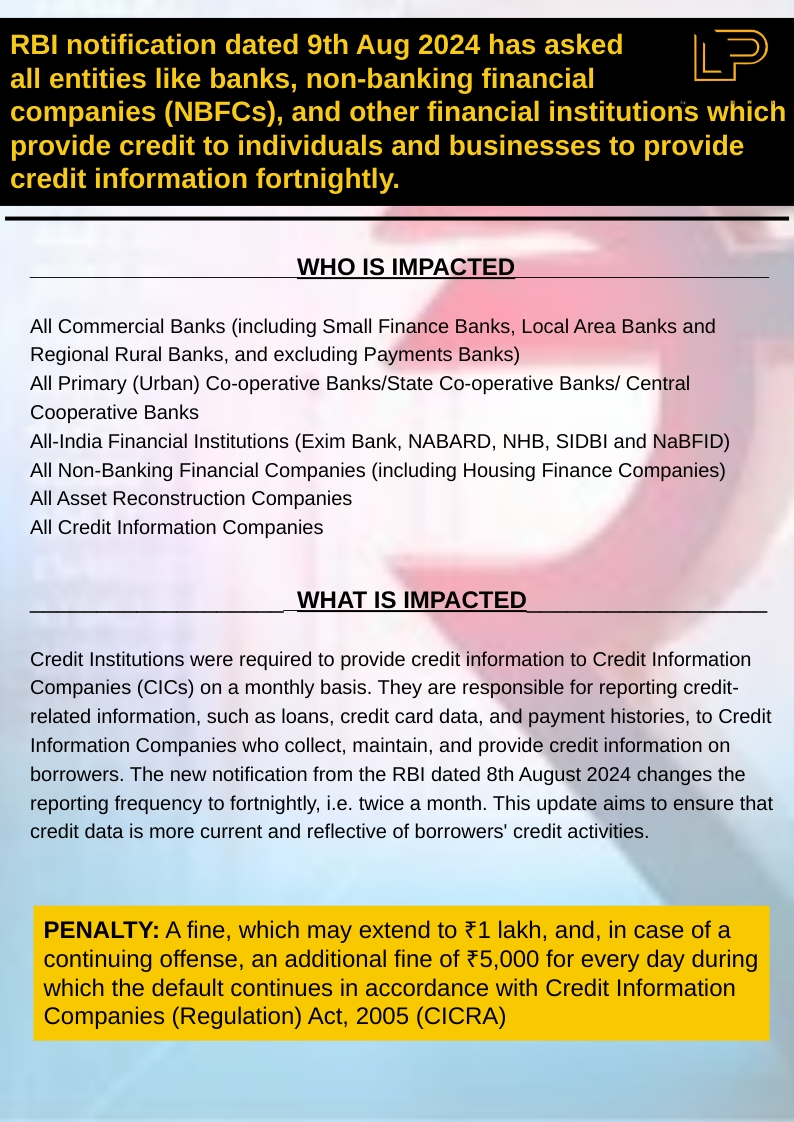

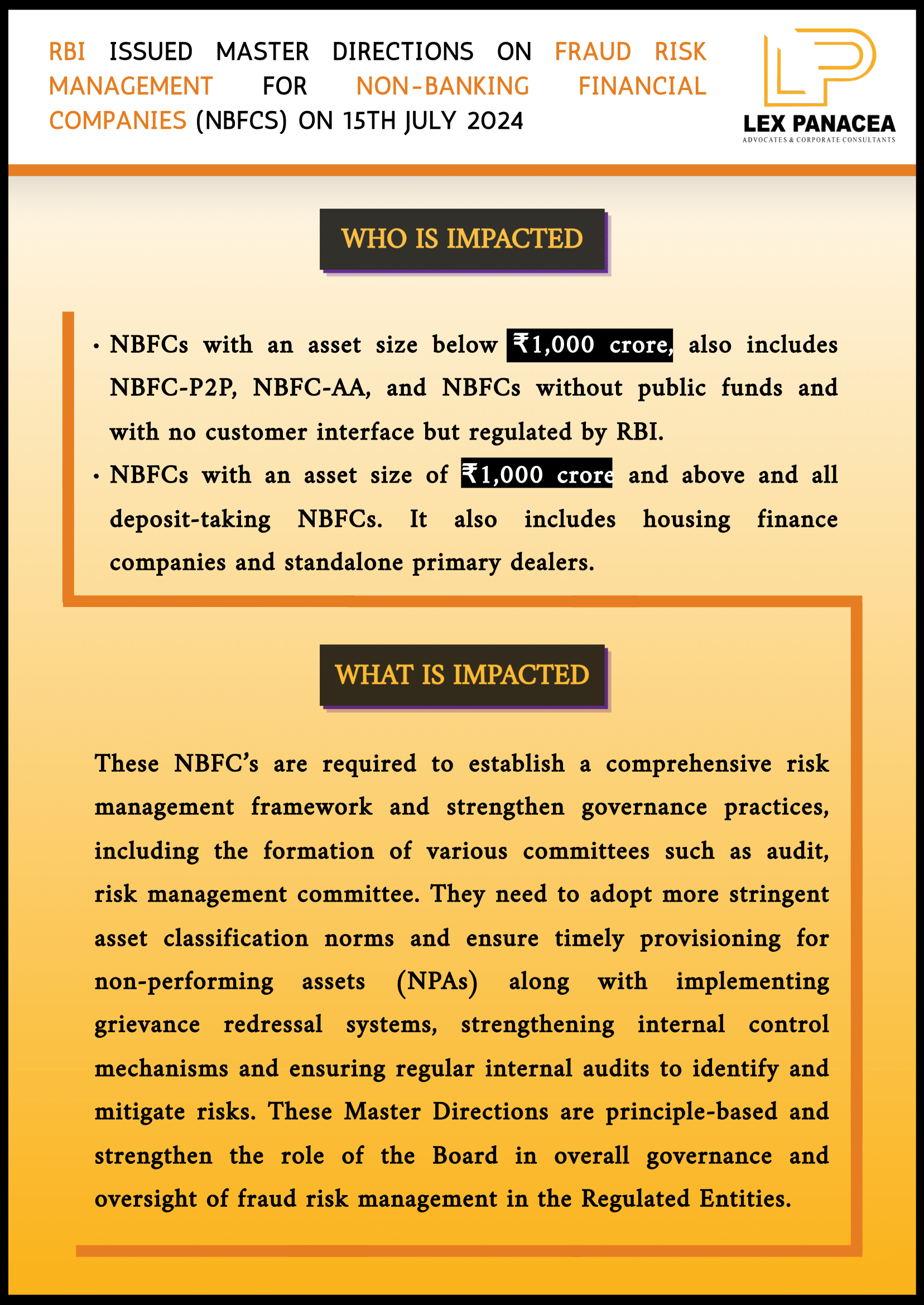

- Banking & Finance

- Capital Markets

- Competition & Antitrust

- Investigation/White Collar Crimes

- Corporate M&A

- Data Privacy & Protection

- Dispute Resolution

- Employment Labour & Benefits

- Financial Services

- Funds

- Private Client Practise:

- Intellectual Property

- Private Equity & Venture Capital

- Regulatory & Securities

- Restructuring & Insolvency

- Startups & Emerging Companies

- Taxation

- Resources

- Contact Us

- Our Video Colabs

Recent Comments